WHY INVEST IN ADDTECH

WHY INVEST IN ADDTECH?

Addtech generates long-term shareholder value through 140 independent subsidiaries. As an active owner, we purposefully but cautiously develop the subsidiaries for sustainable and profitable growth. Since the IPO in September 2001, the Addtech share has achieved an average price increase of 21 percent annually. There are several explanations for our success and we now continue to provide value, with stable and sustainable growth as our overriding objective.

Attractive market profile provides favourable risk diversification | Highly-knowledgeable catalyst for growth | Successful acquisition strategy | ||

Crucially, our shareholder value builds on our entrepreneurial companies, which all strive to be market leaders in their individual niches. Our scalable model enables us to grow in multiple markets. An increased geographical presence and greater spread among customer segments makes us less vulnerable to individual trends and declines. A broad spread builds beneficial resilience. | Addtech is an active owner who works diligently to increase its subsidiaries’ sales and profitability. We combine the flexibility, personal touch and efficiency of small businesses with the resources, networks and long-term perspective of a large corporation. We are constantly evolving and we understand the importance of continuously adapting our operations to the prevailing business climate. By continuously doubling our profits every five years (on average), we have proven our capacity for delivering sustainable profitable growth. | Acquisitions are a cornerstone in how we generate long-term growth in profits and shareholder value. New companies bring additional sales volumes, customers and expertise, and, in particular, motivated employees and entrepreneurs. New companies also bring new opportunities for synergies and development. Our strategy of acquiring cash flow is a successful one, made possible by our stable balance sheet and our focus on cash flow throughout the organisation. |

”Corporate culture is more important than strategy”

Despite maintaining 140 autonomous subsidiaries and operations worldwide, Addtech is not a complicated Group. We acquire successful entrepreneurial companies, together with which we build long-term growth and profitability. We achieve this on the basis of our strong corporate culture, which forms the core of how we conduct business and manage companies. We stand on a solid foundation of simplicity, efficiency and development with a high degree of both freedom and responsibility.

Our scalable business model has been a success factor since the outset in 2001. A beneficial spread between numerous specific niches, segments and geographies makes us less vulnerable and sensitive to negative changes in individual areas.

Our strategy of continuous profitable growth, both organically and through acquisitions, has been proven to be effective. Our principal task as owners is to make life easier for our companies, so that they can focus on continuing their successful development, benefiting from Addtech’s network and our resources in the form of skills and expertise, experience and financing.

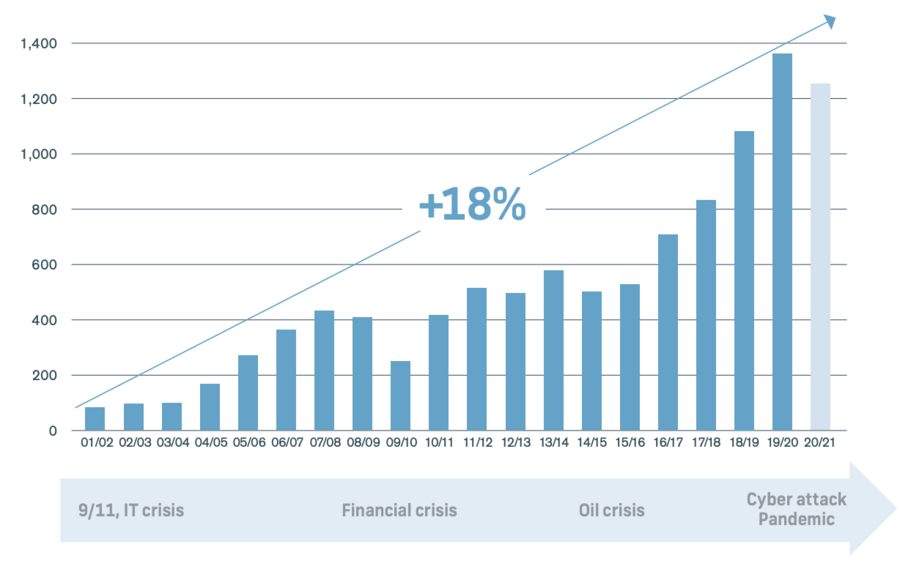

Percent average annual growth, 2001-2021

Addtech’s strategy is to acquire and develop in successful, well-managed and market-leading niche companies with the potential to generate long-term profitable growth. Despite various crises, recessions, cyber attacks and pandemics, we have continuously delivered shareholder value, with an average annual growth of 18 percent since the start in 2001.

+140 acquisitions implemented since 2001