| RISK/DESCRIPTION | ADDTECH’S RISK MANAGEMENT |

|---|---|

| Economy and market | |

| Demand for Addtech’s products and services is greatly influenced by macroeconomic factors beyond Addtech’s control, such as growth and investment appetite in the manufacturing industry, the state of the economy in general and conditions in the global capital market or, as during 2020/2021, outbreaks of pandemics affecting the business climate. A weakening of these factors in the markets in which Addtech operates could have adverse effects on its financial position and earnings. | With a large number of subsidiaries focusing on different niche markets and add-on sales of technical service, support and consumables, Addtech may be less sensitive to economic fluctuations in individual industries, sectors and geographical regions. Addtech also strives continuously to develop businesses that are less dependent on a specific market and to align expenses with specific conditions. |

| Structural changes | |

| Globalisation, digitalisation and rapid technological development drive structural change among customers. Developments may increase demand for Addtech’s advanced services but can also result in Addtech’s customers disappearing through mergers, closures and relocations, to low-cost countries for example. | Addtech’s clear and unique added value services with their high technology content, specialisation in advanced technical advisory services, outstanding service and strong presence in niche markets offset price competition. Addtech’s competitiveness also enables the Company to deliver beyond its immediate geographical region. Combined with the fact that no customer accounts for more than approx 4 percent of consolidated sales, the Group’s exposure to a large number of sectors constitutes a certain degree of protection against adverse impacts on earnings. |

| Competition | |

| Most of Addtech’s subsidiaries operate in sectors that are vulnerable to competition. In addition, consolidation may occur among suppliers in the sector, and larger merged suppliers may have a broader offering, which could result in pressure on prices. Future competitive opportunities for the subsidiaries will depend on their ability to be at the leading edge of technology and to respond quickly to new market needs. Increased competition or a decline in the ability of a subsidiary to meet new market needs could have a negative impact on Addtech’s financial position and earnings. | Addtech strives to offer products and services for which price is not the sole deciding factor. By working closely with both suppliers and customers, we are continuously developing our know-how and competitiveness. We add value in the form of wide-ranging technological knowledge, reliability of delivery, service and availability, limiting the risk of customers decreasing their demand. To reduce the risk of competition from suppliers, Addtech focuses continuously on ensuring that collaboration with the Group is the most profitable sales strategy |

| Environment | |

| Changed environmental legislation could affect product sales, goods transports and the way in which our customers use the products. An inability to meet customers’ increased environmental requirements can affect sales. There is also a risk that the corporate ID number of a Group subsidiary could entail a historical liability for the company under the Swedish Environmental Code. | Addtech’s subsidiaries are primarily engaged in commerce and operations with limited direct environmental impact. The Group conducts limited production. The Group monitors operations and environmental risks through its sustainability reporting and all companies comply with the Group’s Code of Conduct. In conjunction with acquisitions, Addtech conducts an analysis of the potential target’s corporate ID number to counter the risk of being held liable for historical environmental issues. |

| Climate risks | |

| Climate change entails both transitional risks and physical risks that can have a negative impact on Addtech and its subsidiaries. Relevant transition risks are higher taxes on carbon dioxide-intensive products and services, revolutionary changes in the market and increased raw material prices. Relevant physical risks are increased operating and capital costs, as a result of more frequent damage to our operations caused by the effects of climate change, such as more extreme weather. | For Addtech, the management of climate-related risks is an important parameter for future business development, and we have carried out scenario analyses to identify financial risks linked to climate change. Risks linked to climate change are part of our analysis of potential acquisitions. The Group works to integrate climate risks into major investments. |

| Ability to recruit and retain staff | |

| Addtech’s continued success depends on being able to retain experienced employees with specific skills and to recruit skilled new people. There are a number of key individuals, both among senior executives and among the Group’s employees in general. There is a risk that one or several senior executives or other key individuals could leave the Group at short notice, for reasons of stress, working environment or development opportunities, for example. In the event that Addtech fails to recruit suitable replacements, or to find skilled new key individuals in the future, this could have a negative impact on Addtech’s financial position and earnings. | Addtech prioritises building favourable conditions for employees to develop within the Group and to enjoy their work. The Group’s acquisition strategy includes ensuring that key individuals in the companies are highly motivated to continue running their companies independently within the Group. The Addtech Business School is aimed at both new employees and senior executives and serves to increase internal knowledge transfer, promote personal development among employees and develop the corporate culture. The Group’s regular employee surveys serve to ascertain how employees view their employers and their work situation, and what might be improved and developed. |

| Organisation | |

| Addtech’s decentralised organisation is based on subsidiaries bearing extensive local responsibility for their operations. This imposes high standards on financial reporting and monitoring, with shortcomings in this regard potentially leading to inadequate control of the operations. | Addtech controls its subsidiaries through active board participation, Group-wide policies, financial targets and instructions regarding financial reporting. By being an active owner and monitoring the development of the subsidiaries, risks can quickly be identified and addressed in accordance with the Group’s internal guidelines. |

| Seasonal effects | |

| There is a risk that Addtech’s operations, earnings and cash flow could be affected by strong seasonal effects driven by customer demand. | No significant seasonal effects are associated with Addtech’s sales of high-tech products and solutions to companies in the manufacturing and infrastructure sectors. However, the number of production days, customer demand and the willingness to invest may vary from one quarter to another. |

| Business ethics and human rights | |

| Addtech’s continued success is strongly dependent on our good reputation and business ethics. Human rights violations in the Group’s own operations or those of its suppliers would have a negative impact on the Group’s reputation among employees, customers and other stakeholders and influence demand for the Group’s products. | Internally, the Group works with business ethics through initiatives including the Business School and it is clearly communicated in our internal Code of Conduct. Compliance with anti-corruption and human rights regulations is reviewed annually. Addtech’s many favourable relationships with carefully selected suppliers reduce the risk of human rights violations occurring among our suppliers. To ensure that the Group’s high standards in terms of business ethics are maintained, all suppliers are also required to observe Addtech’s Code of Conduct for Suppliers and specific supplier audits are conducted. |

| Acquisitions and goodwill | |

| Historically, Addtech has, for the most part, grown through acquisitions. Strategic acquisitions will continue to represent an important part of our growth. However, there is a risk that Addtech will not be able to identify suitable objects for acquisition due, for example, to competition with other buyers. Expenses attributable to acquisitions may also be higher than expected, and positive impacts on earnings may take longer to realise than expected. The risk of goodwill impairment arises when a business unit underperforms in relation to the assumptions that applied at the time of valuation, and any impairment may adversely affect the Group’s financial position and earnings. Further risks associated with acquisitions include integration risks and exposure to unknown commitments. | Addtech has many years of solid experience in acquiring and pricing companies. All potential acquisition targets and their operations are examined carefully before implementing the acquisition. There are well-established procedures and structures for pricing and implementing the acquisition, as well as for integrating the acquired companies. In the agreements, an effort is made to obtain the necessary guarantees limiting the risk of unknown liabilities. The large number of companies acquired entails a significant distribution of risk. |

| Financial risks | |

| The Group is exposed to various financial risks. Currency risk is the risk of exchange rates having an adverse impact on Addtech’s financial position and earnings. Transaction exposure is the risk that arises because the Group has incoming and outgoing payments based on payment flows in foreign currencies. Translation exposure arises because the Group, through its subsidiaries, has net investments in foreign currencies. The Group is also exposed to financial risk, that is, the risk that financing of the Group’s capital requirements is made more difficult or expensive. Interest rate risk is the risk that unfavourable changes in interest rates have an adverse impact on Addtech’s financial position and earnings. | Addtech strives for structured and efficient management of the financial risks that arise in its operations, in accordance with the financial policy adopted by the Board of Directors. The financial policy expresses the ambition of identifying, minimising and controlling financial risks, and establishes responsibility for managing how such risks are to be delegated within the organisation. The aim is to minimise the impact of financial risks on earnings. See Note 3 for a more detailed description of how Addtech manages financial risks. |

| Suppliers and customers | |

| To deliver products, Addtech is dependent on the ability of external suppliers to fulfil agreements in terms of volume, quality, delivery date, etc. Deliveries that are erroneous or delayed, or that do not occur, may have an adverse impact on Addtech’s financial position and earnings. Addtech’s reputation is also dependent on its suppliers’ ability to maintain a high level of business ethics, in terms of, for example, human rights, working conditions and the environment. Agreements with customers vary, for example in terms of contract length, warranties and limitations of liability. In some supplier relationships there are no written supplier agreements, which could result in legal uncertainty regarding the content of the agreement. | Addtech’s numerous and favourable relationships with carefully selected suppliers reduce the risk of Addtech not being able to deliver as promised. To ensure that the Group’s high standards in terms of business ethics are maintained, all suppliers are also required to observe Addtech’s Code of Conduct for Suppliers. Most of the companies also perform specific supplier reviews. In a longer-term perspective, Addtech is not dependent on any individual supplier or customer. Addtech’s largest customer accounts for about 4 percent of consolidated net sales. |

| IT security and cyber risks | |

| Throughout society, the digital risks are continuously rising. Like most companies, Addtech and its subsidiaries rely on various information systems and other technologies to manage and develop their operations. Unplanned outages and cyber security incidents, such as data breaches, viruses, sabotage and other cybercrimes, can result in both loss of revenue and loss of reputation. IT events or cyber incidents among third parties, including suppliers or customers, can affect Addtech’s capacity to deliver products and services and to generate profits. | To safeguard stable IT environments and prevent incidents, Addtech conducts regular risk assessments, as well as maintenance and reviews of the IT security at both the Group and subsidiary levels. Addtech work with systematic analysis to identify and assess IT risks. Addtech also engages external cyber security experts to ensure that the level of security is adjusted and updated on the basis of prevailing threat scenarios and customers’ increasing cyber security demands. |

Employees and development

Employees

At the end of the financial year, the number of employees was 3,133, compared to 2,981 at the beginning of the financial year. During the financial year, completed acquisitions resulted in an increase of the number of employees by 321. The average number of employees in the latest 12-month period was 3,068.

| 2020/2021 | 2019/2020 | 2018/2019 | |

| Average number of employees | 3,068 | 2,913 | 2,590 |

| Proportion of men | 74% | 74% | 74% |

| Proportion of women | 26% | 26% | 26% |

| Age distribution up to 29 years old | 10% | 11% | 11% |

| 30-49 years | 48% | 48% | 48% |

| 50 and older | 42% | 41% | 41% |

| Average age | 46 år | 45 år | 45 år |

| Personnel turnover | 12% | 10% | 12% |

| Average length of employment | About 10 years | About 9 years | About 9 years |

Research and development

The Addtech Group conducts limited research and development. The Group’s business model is to offer high-tech products and solutions to customers primarily within manufacturing industry and infrastructure.

Future prospects and events after the reporting period

Principles for remuneration of senior executives

The Board of Directors has resolved to propose that the Annual General Meeting in August 2021 approve the same guidelines as in the preceding year:

The guidelines do not cover remunerations determined by the Annual General Meeting. For employment relationships subject to non-Swedish regulations, appropriate adjustments may be made regarding pension benefits and other benefits to comply with mandatory regulations or established local practices and to satisfy, as far as possible, the overall intention of those guidelines.

The guidelines shall apply to the remuneration of the CEO and other members of Addtech’s Group Management. The guidelines also apply to Board members to the extent that they receive remuneration for services rendered to the company beyond their Board assignments. Where appropriate, the provisions applicable to the company also apply for the Group.

How the guidelines foster the company’s business strategy, long-term interests and sustainability

Successfully implementing the company’s business strategy and advancing its long-term interests, including its continuity, require Addtech to recruit and retain qualified employees. This requires the company to be able to offer competitive overall compensation, which these guidelines allow. Overall remuneration shall be market-based and competitive and shall be set in relation to responsibilities and powers.

The forms of compensation, etc.

Remuneration shall be market-based and include the following components: fixed salary, any variable salary under separate agreements, pensions and other benefits. In addition, the Annual General Meeting may, independently of these guidelines, determine share and share price-related remunerations.

Fixed salary

Fixed salary shall consist of fixed cash salary and shall be reviewed annually. The fixed salary shall be competitive and reflect the requirements of the position in terms of expertise, responsibility, complexity and the manner in which the position contributes to the achievement of business objectives. The fixed salary shall also reflect the executive’s performance and should therefore be specific to each individual and differentiated.

Variable salary

In addition to fixed salary, the CEO and other senior executives may from time to time and in accordance with separate agreements, receive variable salary on meeting pre-agreed criteria. Any variable salary shall consist of annual cash salary and may not exceed 40 percent of fixed annual salary. In addition, an additional premium of 20 percent may be paid on variable salary used by the executive to acquire shares in Addtech AB. To avoid unhealthy risk-taking, there should be a fundamental balance between fixed and variable remuneration. Fixed salary shall account for a sufficient portion of the senior executive’s total remuneration to allow the variable portion to be reduced to zero. Variable salary shall be tied to one or more predetermined and measurable financial criteria established by the Board of Directors, such as the Group’s earnings growth, profitability and cash flow. By linking the remuneration of senior executives to the company’s results, variable remunerations promote the implementation of the company’s business strategy, long-term value creation and competitiveness. The terms and calculation bases for variable salary are to be determined for each financial year. Compliance with variable salary payment criteria shall be measurable over a period of one financial year. Variable salary is settled in the year after which it was earned.

At the end of the measurement period for compliance with variable salary criteria, it shall be assessed to what extent the criteria have been met. The Board of Directors is responsible for the assessment of variable cash remuneration for the CEO. The CEO is responsible for the assessment of variable cash remunerations to other senior executives. Where financial targets are applied, the assessment shall be based on the financial information most recently published by the company.

The terms for variable salary may be designed such that, under exceptional economic circumstances, the Board of Directors retains the option of limiting variable salary or refraining from paying it if such a measure is deemed reasonable. In designing variable remunerations for senior management, the Board of Directors shall consider introducing reservations that (i) condition the payment of certain portions of such remuneration to the services on which the vesting is based proving sustainable over time, and (ii) allow the company to recover any such remuneration disbursed based on information subsequently proven to be manifestly incorrect.

Additional variable cash compensation may be paid under extraordinary circumstances, provided that such extraordinary arrangements are limited in time and are made only at the individual level, for the purpose of either recruiting or retaining executives, or as compensation for services rendered beyond the ordinary duties of the individual. Such remuneration may not exceed an amount equal to 40 percent of fixed annual salary and shall not be paid more than once a year and per individual. Such remunerations shall be approved by the Board of Directors following a proposal by the Remuneration Committee.

Pension

For the CEO and other senior executives, pension benefits are paid in accordance with individual agreements. As a general rule, pension benefits, including health insurance, shall take the form of defined-contribution solutions, the amount of pension disbursed being determined by the outcome of the pension insurance policies taken out. Defined-benefit pension solutions may occur in individual cases, however. Variable salary can be pensionable. Premiums for defined-contribution pension solutions shall not exceed 40 percent of pensionable salary. Pensionable salary corresponds to fixed monthly salary multiplied by a factor of 12,2 and, where appropriate, variable salary. Wage waivers can be used to enhance occupational pension by means of individually determined pension provisions,

provided that the total cost to the company is rendered neutral.

Other benefits

Other benefits, potentially including a company car, travel benefits, supplementary health and care insurance, as well as occupational health and wellness allowances, shall be market-based and constitute only a limited part of the total remuneration. Premiums and other costs related to such benefits may total at most 10 percent of fixed annual salary.

Terms and conditions of termination

All senior executives must observe a notice period of six months. In the event of termination by the company, a notice period of at most 12 months shall apply. In the event of termination by the company, senior executives may (in addition to salary and other employment benefits during the period of notice) be entitled to severance pay equal to at most 12 months’ fixed salary. This severance pay is not offset against other income. No severance pay shall be paid in the event of resignation by the

employee.

In addition to severance pay, compensation for any restriction of competition may be paid. Such compensation shall compensate for any loss of income and shall be paid only to the extent that the former executive is not entitled to severance pay. This compensation shall be based on the fixed salary at the time of dismissal and shall not exceed 60 percent of the fixed salary at the time of termination (subject to mandatory collective agreement provisions) and shall be paid for the period of the commitment to restrict competition, which shall not extend beyond 12 months after the termination of employment.

Remuneration of Board members

In specific cases, it shall be possible, for a limited period of time, to pay elected members of Addtech’s Board of Directors for work within their respective areas of expertise that does not constitute Board work. Market- based fees shall be payable for such work (including services performed through a company wholly owned by the Board member), provided that such work contributes to the implementation of Addtech’s business strategy and the safeguarding of the company’s long-term interests, including its sustainability. Such consultancy fees may never exceed the annual Board fee paid to each Board member.

Salary and conditions of employment for employees I

n preparing the Board’s proposal for these remuneration guidelines, the remuneration and conditions of employment of the company’s employees have been considered. This has been done by including information on employees’ overall remuneration, the components of that remuneration, as well as increases in remuneration and the rates of increase over time, in the decision-making processes of the Remuneration Committee and Board of Directors in assessing the fairness of the guidelines and the limitations they impose.

Preparation and decision-making process

The Board of Directors has resolved to establish a Remuneration Committee. The Committee’s tasks include preparing principles for the remuneration of senior executives and the proposed guidelines for the remuneration of senior executives approved by the Board of Directors. The Board of Directors shall draw up proposals for new guidelines at least every four years and submit its proposals for adoption by the Annual General Meeting. The guidelines shall apply until new guidelines are adopted by the General Meeting. The Remuneration Committee shall also monitor and evaluate programs for variable remunerations for senior executives, the application of guidelines for the remuneration of senior executives and current remuneration structures and levels within the company. Remunerations for the CEO shall be determined by the Board of Directors following preparation and recommendation by the Remuneration Committee within a framework of approved principles. Following proposals by the CEO, the Remuneration Committee determines remunerations for other members of Group Management. The Board of Directors is informed of the Remuneration Committee’s decisions. The Board of Directors does not address or determine matters of remuneration not involving the CEO or other senior executives, to the extent that they are affected by such matters.

Share-based incentive programmes determined by the Annual General Meeting

Each year, the Board of Directors shall assess the need for share-based incentive programs and, if necessary, submit proposals for resolution by the Annual General Meeting. Decisions on possible share and share price-related incentive programs aimed at senior executives shall be made by the Annual General Meeting and shall contribute to long-term value growth.

Departure from the guidelines

In individual cases and where there are specific reasons for doing so, and where a deviation is necessary to satisfy the company’s long-term interests (including its sustainability) or to safeguard the company’s financial viability, the Board of Directors may decide to partially or entirely waive these guidelines. As stated above, the Remuneration Committee’s is tasked with preparing decisions by the Board of Directors on matters of remuneration, including decisions on deviations from the guidelines. Decisions on deviations from the guidelines shall be presented at the ensuing Annual General Meeting. For further information on remuneration to senior executives, see also Note 6 Employees and personnel expenses.

Dividend

Addtech’s dividend policy is to propose a dividend that exceeds 30 percent of average Group profit after tax over a business cycle. In proposing a dividend, the Group’s equity, long-term financing and investment needs, growth plans and other factors are taken into account that the Company’s Board of Directors consider important.

The Board of Directors has resolved to propose dividend of SEK 1.20 (1.00) per share to the Annual General Meeting in August 2021. The dividend corresponds to a total of SEK 323 million (269), corresponding to a payout ratio of 46 (31) percent.

Parent Company

The operations of the Parent Company, Addtech AB, include Group Management and the Group’s reporting and financial management staff units. Parent Company net sales amounted to SEK 58 million (71) and profit after financial items was SEK 378 million (-41). Net investments in non-current assets were SEK 0 million (0). The Parent Company’s financial net debt was SEK 286 million (341) at the end of the financial year.

Future prospects and events after the reporting period

Future prospects

Addtech operates in an international market in which demand is largely influenced by macroeconomic factors. Group companies operate in different but carefully selected niches, resulting in a smoothing effect between sectors, geographical markets and customer segments. Our independent companies work continuously to adapt to changes based on their markets and competitive situation.

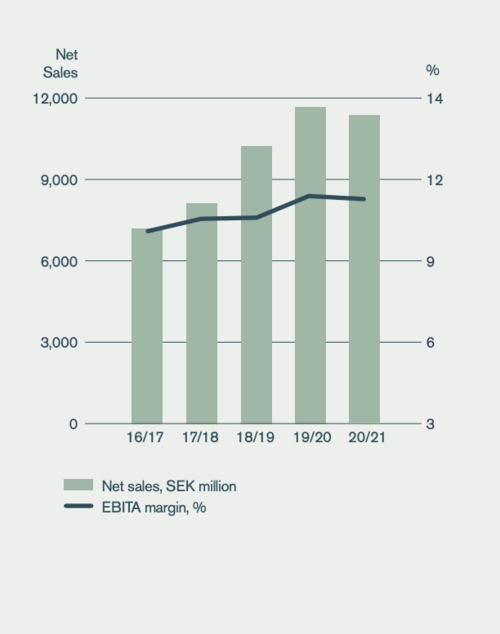

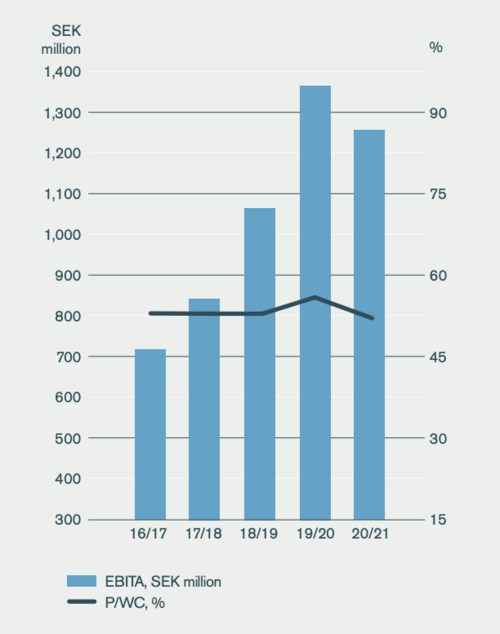

Historically, Addtech’s continuous pursuit of profit growth, profitability (P/WC) and development have provided favourable average value growth. Our cash flow and financial position form a stable foundation for continued long-term profitable growth based on the same business concept.

We have a favourable underlying momentum in the Group, with good positions in structurally driven areas of development, such as energy conversion and electrification. In times of crisis, companies with stable business models and strong financial circumstances are able to benefit from new opportunities that arise. For this reason, it is important that we continue to focus on our long-term objectives.

The risk and uncertainty factors are otherwise the same as in earlier periods. The Parent Company is indirectly affected by the above risks and uncertainties through its function in the Group.

Events following the close of the financial year

On 1 April, ESi Controls Ltd., Great Britain, was acquired to become part of the Power Solutions business area. ESi (Energy Saving Innovative) Controls is a UK based company designing and delivering energy efficient electronic controls for heating and smart building applications. ESi Controls Ltd. has a turnover of approximately GBP 8 million and have 15 employees.

On 1 April, Hydro-Material Oy, Finland, was acquired to become part of the Components business area. Hydro-Material delivers hydraulic solutions and cooling systems to primarily the market segments special vehicles and the manufacturing industry. Hydro-Material Oy has sales of approximately EUR 5 million and 5 employees.

On 3 May IETV Elektroteknik AB, Sweden, was acquired to become part of the Energy business area. IETV Elektroteknik AB is a knowledge company that offers qualified services in power supply to railways, hydropower and industry. IETV Elektroteknik AB has 38 employees and has annual sales of approximately SEK 80 million.

On 11 May, AVT Industriteknik AB, Sweden, was acquired to become part of the Automation business area. AVT designs and manufactures industrial automation equipment primarily for the manufacturing, pharma and automotive industry. The offering includes electrical and mechanical design, programming of PLC and industrial robots, vision technology, installation and service. The company has 42 employees and sales of around SEK 70 million.

| Proposed allocation of earnings 2020/2021 | |

| The following amounts are at the disposal of the Annual General Meeting of Addtech AB: | 2020/2021 |

| Retained earnings | SEK 192 million |

| Profit for the year | SEK 587 million |

| TOTAL | SEK 779 million |

| The Board of Directors and the CEO propose that the funds available be allocated as follows: | |

| That a dividend of SEK 1.20 per share be paid to shareholders* | SEK 323 million |

| To be carried forward | SEK 456 million |

| TOTAL | SEK 779 million |

| * Calculated based on the number of shares outstanding at 30 June 2021. The total dividend payout may change if the number of repurchased treasury shares changes prior to the proposed dividend record date of 1 September 2021. |