ADDTECH SHARES

Share price trend and trading

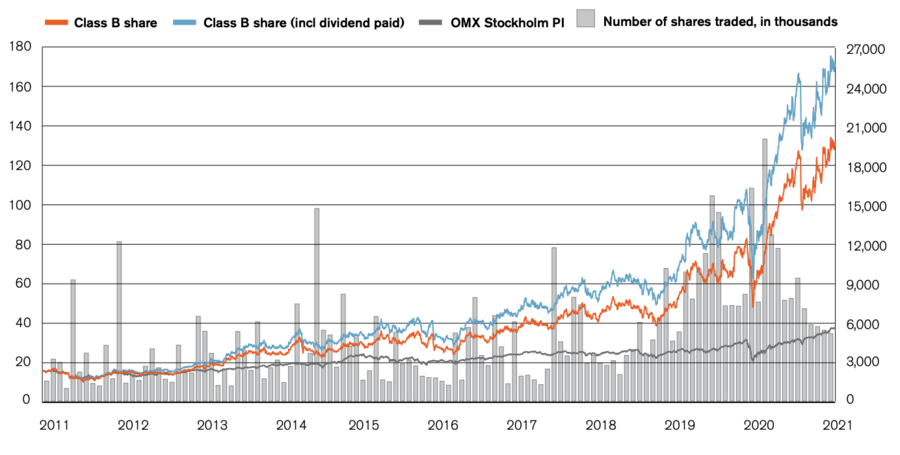

Addtech Addtech’s Class B shares are listed on Nasdaq Stockholm. Since the listing in September 2001, the average price increase, up to and including 31 March 2021, has been 21 percent annually. Over the corresponding period, the exchange’s OMX Stockholm index changed by an average 7 percent.

Over the financial year, the price of the Addtech share rose by 113 percent. Over the corresponding period, the exchange’s OMX Stockholm index rose by 57 percent. The highest price paid during the year was SEK 138, which was noted on 12 March 2021. The lowest price paid was SEK 58.45, which was noted on 2 April 2020. The closing price at the end of the financial year was SEK 130, corresponding to a market capitalisation of SEK 33.8 billion (15.9).

During the period from 1 April 2020 to 31 March 2021, 60.7 million shares (29.9) were traded for a total value of approximately SEK 10.9 billion (7.9). In relation to the average number of Class B shares outstanding, this corresponds to a turnover rate of 40 percent (47). Broken down per trading day, an average 241,967 Addtech shares (119,597) were traded for an average value of approximately SEK 43 million (32).

Share capital

At the end of the period, share capital amounted to SEK 51.1 million divided into the following number of shares with a quota value of SEK 0.19 per share.

| Share class | Number of shares | Number of votes | Percentage of capital | Percentage of votes |

| Class A shares, 10 votes per share | 12,885,744 | 128,857,440 | 4.7 | 33.1 |

| Class B shares, 1 vote per share | 259,908,240 | 259,908,240 | 95.3 | 66.9 |

| Total number of shares before repurchases | 272,793,984 | 388,765,680 | 100.0 | 100.0 |

| Of which, repurchased Class B shares | -3,519,272 | 1.3 | 0.9 | |

| Total number of shares after repurchases | 269,274,712 |

The Annual General Meeting in August 2020 resolved to implement a 4:1 share split. The division resulted in an increase in the number of shares to 272,793,984, of which 12,885,744 were Class A shares and 259,908,240 were Class B shares. The new shares were registered in the shareholders’ accounts on 17 September 2020.

Chapter 6, Section 2a of the Swedish Annual Accounts Act requires listed companies to disclose specific circumstances that may affect the prospects for acquiring the Company via a public share offer. In the event of the Company being de-listed from Nasdaq OMX Stockholm or a party other than the present principal shareholder attaining an ownership holding exceeding 50 percent of the capital or votes, the granted credit line in terms of contractual credit facilities of SEK 2,500 million and overdraft facilities of SEK 1,300 million can be terminated.

Repurchases of treasury shares and incentive programmes

The Annual General Meeting in August 2020 authorised the Board of Directors to repurchase a maximum of 10 percent of all shares in the Company during the period extending until the 2021 Annual General Meeting. During the financial year Addtech repurchased none of its own Class B shares. At the end of the year, 3,519,272 (4,199,672) of the Company’s own Class B shares were held, with an average purchase price of SEK 32.73 (32.73). These shares correspond to 1.3 percent (1.5) of the number of shares issued and 0.9 percent (1.1) of the votes.

At the end of the financial year, Addtech had four outstanding call option programmes for a total of 3,590,000 shares. Call options issued on repurchased shares entail a dilution effect of about 0.3 percent over the past 12-month period. Addtech’s holdings of treasury shares are expected to match the needs of the outstanding call option programmes.

| Outstanding programme | Number of options | Corresponding number of shares | Proportion of total shares |

Initial redemption price | Exercise price per share | Expiration period |

| 2020/2024 | 250,000 | 1,000,000 | 0.4% | 538.10 | 134.53 | 4 Sep 2023 - 5 Jun 2024 |

| 2019/2023 | 300,000 | 1,200,000 | 0.4% | 321.80 | 80.45 | 5 Sep 2022 - 2 Jun 2023 |

| 2018/2022 | 300,000 | 1,200,000 | 0.4% | 232.90 | 58.23 | 6 Sep 2021 - 3 Jun 2022 |

| 2017/2021 | 47,500 | 190,000 | 0.1% | 178.50 | 44.62 | 14 Sep 2020 - 4 Jun 2021 |

| Total | 897,500 | 3,590,000 |

Ownership structure

On 31 March, 2021, the total number of shareholders was 9,409 (6,208), of whom 6,942 (5,063) each held 1,000 shares or less. The 15 largest shareholders accounted for 62.6 (61.6) percent of the total number of shares and 72.3 (71.5) percent of the total number of votes. Anders Börjesson (including related parties) is the largest shareholder in terms of votes, with a shareholding corresponding to 16.4 percent, followed by Tom Hedelius, with a shareholding corresponding to 15.2 percent. The proportion of foreign owners corresponded to 46 percent (45) of total capital.

Additional information

Addtech’s website www.addtech.com is updated continuously with information about shareholder changes and share price performance. The site also presents information about which analysts monitor Addtech.

Key indicators

| 2020/2021 | 2019/2020 | 2018/2019 | ||

| Earnings per share (EPS), SEK | 2.60 | 3.20 | 2.45 | |

| Shareholders’ equity per share, SEK | 11.95 | 11.25 | 9.20 | |

| Price/earnings ratio | 50 | 19 | 20 | |

| Share dividend, SEK | 1.20 | 1) | 1.00 | 1.25 |

| Payout ratio, % | 46 | 31 | 51 | |

| Dividend yield, % | 0.9 | 1.6 | 2.6 | |

| Last price paid, SEK | 130.00 | 61.13 | 48.25 | |

| Price/equity, multiple | 10.3 | 5.4 | 5.2 | |

| Market capitalisation, SEKm | 33,788 | 15,885 | 12,539 | |

| Average number of shares outstanding | 269,050,749 | 268,493,332 | 268,186,844 | |

| Number of shares outstanding at year-end | 269,274,712 | 2) | 268,594,312 | 268,228,436 |

| Number of shareholders at year-end | 9,409 | 6,208 | 5,191 | |

| The number of shares has been recalculated with regard to the share split (4:1) implemented in September 2020 and applied in all calculations of key financial indicators in terms of SEK/share. | ||||

| 1) Dividend proposed by the Board of Directors | ||||

| 2) The difference between the total number of shares and shares outstanding equals the shares repurchased by Addtech: 3,519,272 Class B shares at 31 March 2021. | ||||

Addtech’s largest shareholders, 31 March 2021

| Proportion of | ||||

| Shareholder | Class A shares | Class B shares | capital, % | votes, % |

| Anders Börjesson (with companies and family members) | 6,348,648 | 486,000 | 2.5 | 16.4 |

| Tom Hedelius | 5,895,960 | 64,800 | 2.2 | 15.2 |

| State Street Bank And Trust Co, W9 | 28,411,098 | 10.4 | 7.3 | |

| SEB Investment Management | 24,002,559 | 8.8 | 6.2 | |

| Swedbank Robur Fonder | 23,403,827 | 8.6 | 6.0 | |

| The Northern Trust Company | 14,866,164 | 5.5 | 3.8 | |

| JP Morgan Chase Bank NA | 13,279,546 | 4.9 | 3.4 | |

| Lannebo Fonder | 13,174,733 | 4.8 | 3.4 | |

| Brown Brothers Harriman & Co. W9 | 11,547,330 | 4.2 | 3.0 | |

| Sandrew AB | 7,200,000 | 2.6 | 1.9 | |

| CBNY-Norges Bank | 4,842,206 | 1.8 | 1.2 | |

| Odin Fonder Norden | 4,664,082 | 1.7 | 1.2 | |

| Säve family | 4,470,000 | 1.6 | 1.1 | |

| Odin Fonder Sverige | 4,100,000 | 1.5 | 1.1 | |

| Margareta Von Matérn | 4,099,932 | 1.5 | 1.1 | |

| Total 15 largest owners 3) | 12,244,608 | 158,612,277 | 62.6 | 72.3 |

| 3) The proportion of capital and votes includes treasury shares held by Addtech AB. | ||||

Size classes

| Number of shares | % of share capital | Number of shareholders | % of number of shareholders |

| 1 - 500 | 0 | 6,138 | 65 |

| 501 - 1 000 | 0 | 804 | 9 |

| 1 001 - 5 000 | 1 | 1,425 | 15 |

| 5 001 - 10 000 | 1 | 370 | 4 |

| 10 001 - 15 000 | 1 | 146 | 2 |

| 15 001 - 20 000 | 1 | 103 | 1 |

| 20 001 - | 96 | 423 | 4 |

| Totalt | 100 | 9,409 | 100 |

Holdings by category

| 2020/2021 | 2019/2020 | |||

| Number of shareholders | Percentage of capital | Number of shareholders | Percentage of capital | |

| Swedish shareholders | 8,897 | 54 | 5,822 | 55 |

| Foreign shareholders | 512 | 46 | 386 | 45 |

| Total | 9,409 | 100 | 6,208 | 100 |

| Legal entities | 774 | 82 | 589 | 81 |

| Natural persons | 8,635 | 18 | 5,619 | 19 |

| Total | 9,409 | 100 | 6,208 | 100 |