CORPORATE GOVERNANCE

Principles of corporate governance

The Addtech Group views sound corporate governance as an important basis on which to build a trustful relationship with shareholders and other key parties. The Swedish Code of Corporate Governance, applied by the Group, seeks to achieve a favourable balance between shareholders, the Board of Directors and senior management. In Addtech’s operations, rational corporate governance, imposing strict standards on openness, reliability and ethical values, has always been a guiding principle.

Compliance with the swedish code of corporate governance

Addtech’s shares are admitted to trading on the Nasdaq Stockholm exchange and, accordingly, Addtech complies with the Nasdaq Stockholm Rule Book for Issuers. As a listed company, Addtech also applies the Swedish Code of Corporate Governance (the Code), which can be accessed via www.bolagsstyrning.se. Deviations from the Code and the motivations for these are accounted for in this text on an ongoing basis. The company deviates on one point in the section on the Quarterly review by the auditors.

This Corporate Governance Report has been reviewed by the company’s auditors. The URL of the company’s website is www.addtech.com

Compliance with applicable exchange rules

No violations of applicable exchange rules occurred in 2020/2021 and Addtech’s operations were conducted in accordance with generally accepted stock market practices.

Shares and shareholders

Shares and shareholders Addtech AB’s share register is maintained by Euroclear Sweden AB. According to this share register, Addtech had 9,409 shareholders as of 31 March 2021, with a total 272,793,984 shares divided into 12,885,744 Class A shares, conveying ten votes apiece, and 259,908,240 Class B shares, conveying one vote apiece. There were 388,765,680 votes in total. More information regarding Addtech’s share and shareholders can be found in the Addtech share section of this Annual Report.

Key events in 2020/2021

The resolutions of Addtech’s Annual General Meeting were announced on 28 August 2020, which included a dividend of SEK 1.00 per share, amounting to a dividend payout ratio of 31 percent and corresponding to SEK 269 million in total. The Annual General Meeting also resolved on a share split where the number of shares in the Company was increased by dividing each share, regardless of series, into four shares. During the financial year, a total of 14 acquisitions were conducted, adding annual sales of approximately SEK 1,140 million.

Articles of association

The Articles of Association state that the name of the company is Addtech Aktiebolag and that its financial year extends from 1 April to 31 March. The Articles of Association include no specific provisions regarding the appointment and dismissal of Board members or amendments to the Articles of Association. The Articles of Association contain no limitations regarding the number of votes that may be cast by each shareholder at a General Meeting. The full Articles of Association, adopted in their current form by the Annual General Meeting of 28 August 2020, can be accessed under Investors/Corporate Governance/Articles of Association at the company’s website.

Annual general meeting

Shareholders exercise their influence over the company at the Annual General Meeting, or, where applicable, at an Extraordinary General Meeting, such meetings being Addtech’s highest decision-making body. The Annual General Meeting shall be held in Stockholm within six months of the end of the financial year. At the Annual General Meeting, resolutions are made regarding matters including the election of the Board of Directors and the Chairman of the Board, the election of auditors, the approval of the income statement and balance sheet, the appropriation of the company’s earnings and the discharge from liability of Board members and the CEO, the Nomination Committee and its work, as well as guidelines for the remuneration of senior executives. Addtech’s website presents information regarding the company’s previous Annual General Meetings. Information is also presented there regarding shareholders’ entitlement to have matters addressed by the Annual General Meeting and the deadline by which Addtech must have received shareholders’ requests for these matters to be addressed. No specific arrangements regarding the function of the General Meeting are applied within Addtech due to provisions in the Articles of Association or, as far as the company is aware, to shareholder agreements.

At General Meetings, resolutions are normally passed by a simple majority vote and, in elections, the recipient of the largest number of votes is considered elected. For certain decisions however, such as amendments to the Articles of Association, a qualified majority is required.

2020 Annual general meeting

Addtech’s Annual General Meeting was held on Friday, 28 August 2020 in Stockholm. The meeting was attended by 215 shareholders, in person, by proxy or by postal voting. They represented 64.33 percent of the total number of votes and 51.44 percent of the capital. Anders Börjesson, Chairman of the Board, was elected Chairman of the Meeting.

The Annual General Meeting was attended by a restricted number of Board members and members of Group Management due to the prevailing Covid-19 situation. Authorised public accountant Joakim Thilstedt, Principal Auditor for Addtech also attended the Meeting.

The Annual General Meeting resolved the following:

- That a dividend of SEK 1.00 per share be paid.

- To re-elect Board members Eva Elmstedt, Kenth Eriksson, Malin Nordesjö, Ulf Mattsson, Johan Sjö and Henrik Hedelius and to elect Niklas Stenberg as new Board member. To elect Johan Sjö as Chairman of the Board.

- To re-elect registered auditing firm KPMG AB for a period of one year.

- The Annual General Meeting approved guidelines for the remuneration of senior executives in accordance with the Board of Directors’ proposal.

- The Annual General Meeting resolved, in accordance with the Board of Directors’ proposal, to issue call options on repurchased shares and to transfer repurchased shares to executives.

- Prior to the next Annual General Meeting, the Board of Directors is authorised to acquire a quantity of Class B shares, such that the Company’s holding of own its shares does not, at any given time, exceed 10 percent of the total number of shares in the Company.

- The Board of Directors is authorized to resolve on a new issue of up to 5 percent of the number of B-shares as means of payment during acquisitions.

- The Annual General Meeting resolved, in accordance with the Board of Directors’ proposal, on a share split and related amendment to the Articles of Association.

- The remaining resolutions of the Annual General Meeting are included in the complete minutes of the Meeting, which are available at www. addtech.com together with other details of the Annual General Meeting.

2021 Annual general meeting

Addtech’s 2021 Annual General Meeting will be held on Thursday, 26 August. For further information regarding the 2021 Annual General Meeting, see Addtech’s website, www.addtech.com

Duties of the nomination committee

The Nomination Committee is tasked by the shareholders with assessing the composition and work of the Board of Directors for the Annual General Meeting, with proposing Board members and a Chairman of the Board to the Annual General Meeting, and, when applicable, with proposing the election of a registered auditing firm and auditing fees, as well as principles for how members of the Nomination Committee are appointed.

The members of the Nomination Committee receive no remuneration from the Company for their work on the Nomination Committee.

In preparation for the 2021 Annual General Meeting, the Nomination Committee held 6 minuted meetings. The Nomination Committee’s complete proposal to the Annual General Meeting is presented in the notice convening the Meeting and on the Company’s website.

Composition of the nomination committee

The Annual General Meeting has resolved that the following principles shall apply until further notice. Accordingly, the Annual General Meeting does not adopt such principles and determine the duties of the Nomination Committee annually unless the actual principles or duties are to be amended. The Nomination Committee comprises representatives of the five largest shareholders in terms of votes at the end of the calendar year (grouped by owner as per 31 December). The Chairman of the Board is tasked with convening the first meeting of the Nomination Committee and shall ensure that the Nomination Committee receives relevant information on the results of the Board’s completed evaluation of its work. Furthermore, the Chairman of the Board shall be co-opted if necessary. From among its number, the Nomination Committee appoints a chairman. The composition of the Nomination Committee shall be announced publicly at the latest six months prior to the Annual General Meeting. In accordance with this, the following individuals were appointed as members of the Nomination Committee on 31 December 2020: Anders Börjesson (appointed by Tisenhult Invest), Henrik Hedelius (appointed by Tom Hedelius), Marianne Nilsson (appointed by Swedbank Robur Fonder), Per Trygg (appointed by SEB Investment Management) and Mats Gustafsson (appointed by Lannebo Fonder). The composition of the Nomination Committee was presented in connection with publication of the third quarter report on of 4 February 2021. Elisabet Jamal Bergström replaced Per Trygg as the representative for SEB Investment Management on the Nomination Committee in March 2021.

The composition of the Nomination Committee agrees with the principles set out by the Annual General Meeting.

Members of the Nomination Committee

The Nomination Committee in preparation for the 2021 Annual General Meeting (was appointed by the largest shareholders in terms of votes as of 31 December 2020).

| Name | Representing | Share of votes, % 31 Dec 2020 |

| Anders Börjesson (Chairman) | Holders of Class A shares for Tisenhult Invest | 15.8 |

| Henrik Hedelius | Holders of Class A shares for the Hedelius family | 15.2 |

| Elisabet Jamal Bergström | SEB Investment Management Fonder | 6.2 |

| Marianne Nilsson | Swedbank Robur Fonder | 5.9 |

| Mats Gustafsson | Lannebo Fonder | 3.7 |

| TOTAL | 46.8 |

Duties of the board of directors

The principal duty of the Board of Directors is to manage the Group’s operations on behalf of the shareholders in a manner best meeting the shareholders’ interest in a favourable return on capital over the long term. The Board of Directors bears the ultimate responsibility for Addtech’s organisation and the administration of Addtech’s operations. It is responsible for the Group’s long-term development and strategy, for continuously monitoring and assessing the Group’s operations and for other duties pursuant to the Swedish Companies Act.

Composition of the Board of Directors

In accordance with the Articles of Association, the Board of Directors shall consist of at least three and at most nine members. Members serve from the close of the Annual General Meeting at which they are elected until the close of the ensuing Annual General Meeting. There is no limit to the number of periods for which a member can sit on the Board of Directors consecutively. The 2020 Annual General Meeting re-elected Board members Eva Elmstedt, Kenth Eriksson, Ulf Mattsson, Malin Nordesjö, Johan Sjö and Henrik Hedelius and elected Niklas Stenberg as new Board member. Johan Sjö was elected as Chairman of the Board. A presentation of the Board members is provided in the Board of Directors section in this Annual Report and on the Company’s website.

In preparing its proposal regarding the Board of Directors, the Nomination Committee has applied Section 4.1 of the Code as its diversity policy. Taking the Company’s operations, phase of development and general circumstances into account, this respects the need for the Board of Directors to be appropriately composed and characterised by versatility and breadth in terms of its skills, experience and background. An even gender distribution is to be sought.

Independence of the Board of Directors

Several different types of independence requirements apply to the Board of Directors and its committees. Addtech applies independence requirements stemming from applicable Swedish legislation, the Swedish Code of Corporate Governance and the rules of the Nasdaq Stockholm exchange. Ahead of the Annual General Meeting, the Nomination Committee assesses the independence of the Board of Directors. Except for Johan Sjö who was employed by the Company until 31 August 2019 and Niklas Stenberg who is employed as the CEO of the Company, all Board members are independent in relation to the Company. Of the members who are independent in relation to the Company, Eva Elmstedt, Kenth Eriksson and Ulf Mattsson are also independent in relation to the Company’s major shareholders. Accordingly, it is deemed that the Board of Directors meets the requirement that at least two of the Board members who are independent of the Company shall also be independent of major shareholders.

Rules of procedure

Each year, the Board of Directors adopts written rules of procedure for the work of the Board in accordance with the Swedish Companies Act. The rules of procedure determine the distribution of work between the Board members, including the Board’s committees, the number of regular Board meetings, matters to be dealt with at regular Board meetings and the duties of the Chairman of the Board. The Board of Directors has also issued written instructions stating how financial reports are to be presented to the Board of Directors and how efforts are to be distributed between the Board of Directors and the CEO.

Duties of the Chairman of the Board

The Chairman of the Board is responsible for ensuring that Board work is well organised, conducted efficiently and that the Board of Directors meets its obligations. The Chairman of the Board monitors operations in dialogue with the CEO. The Chairman of the Board is also responsible for ensuring that other Board members are provided the introduction, information and documentation necessary for maintaining a high level of quality in discussions and decisions, and checks that decisions made by the Board of Directors are executed. The Chairman of the Board represents Addtech regarding issues of ownership.

Work of the Board of Directors in 2020/2021

In accordance with the Board of Directors’ rules of procedure, the Board of Directors is to meet in connection with the presentation of interim reports, at an annual strategy meeting and at its annual statutory meeting, and on other occasions if necessary.

The Board of Directors held 10 meetings over the financial year, of which 4 were held before the 2020 Annual General Meeting and 6 following the Annual General Meeting. The following table shows the Board members’ attendance:

| Board member | Elected | Born | Board attendence, total number of meetings* | Remuneration Committee attendance, total number of meetings | Audit Committee attendance, total number of meetings** | Independent in relation to the Company | Independent in relation to the Company's major shareholders | Total remuneration, SEK |

| Johan Sjö (Chairman) | 2008 | 1967 | 10(10) | 2(2) | 4(4) | No | Yes | 790000 |

| Eva Elmstedt | 2005 | 1960 | 10(10) | 4(4) | Yes | Yes | 370000 | |

| Ulf Mattsson | 2012 | 1964 | 10(10) | 4(4) | Yes | Yes | 370000 | |

| Malin Nordesjö | 2015 | 1976 | 10(10) | 2(2) | 4(4) | Yes | No | 420000 |

| Kenth Eriksson | 2016 | 1961 | 10(10) | 4(4) | Yes | Yes | 370000 | |

| Henrik Hedelius | 2017 | 1966 | 10(10) | 4(4) | Yes | No | 370000 | |

| Niklas Stenberg | 2020 | 1974 | 10(10) | No | Yes | - | ||

| Anders Börjesson | 2001 | 1948 | 4(4) | 1(1) | Yes | No | - | |

| * Number of meetings attended by the member, including the statutory meeting. | ||||||||

|

**The Audit Committee comprises the Board of Directors in its entity, except for the Company’s CEO. Its work is performed as an integral part of the work of the Board of Directors. | ||||||||

All meetings followed an approved agenda that was provided to members prior to Board meetings, together with documentation for each agenda item. Regular Board meetings usually take half a day to allow time for presentations and discussions. The CEO, or someone appointed by him, presents all matters concerning the operations of the Company and the Group.

Other Company officials participate in Board meetings to present specific matters or if otherwise deemed appropriate.

The Company’s CFO acts as the Board of Directors’ secretary and as the secretary of the Nomination Committee. The Board of Directors addressed the following at its meetings:

- Approval of significant policies, including the Board of Directors’ rules of procedure, attestation policy, financial policy, Code of Conduct, insider policy, communication policy, sustainability policy and dividend policy.

- Strategic focus and significant targets.

- Key issues involving optimisation of capital structure, financing, dividends, repurchasing of the Company’s own shares, investments, acquisitions and disposals of operations.

- Follow-up and control of operations, financial development, disclosure of information and organisational matters.

- Review and report by the Company’s external auditors.

- Review with the auditors without the presence of Group Management for assessment of the CEO and Group management.

- Assessment of the work of the Board of Directors. Each year, the Chairman of the Board initiates and directs this assessment.

- Approval of interim reports, the Year-end Report and the Annual Report.

- One extraordinary Board meeting in June 2020 addressed the impact on the Group of the Coronavirus pandemic.

- One extraordinary Board meeting in the spring of 2021 addressed the updated IT and information security strategy of the Group.

Assessment of the work of the Board of Directors

The Board of Directors conducts an assessment of its work on an annual basis. Each year, the Chairman of the Board initiates and directs the assessment of the work of the Board of Directors. The assessment serves to further develop working methods, dynamics, efficiency and working climate, as well as the principal focus of the work of the Board of Directors. This assessment also focuses on access to, and the need for, specific areas of expertise among Board members. The assessment includes interviews, joint discussions and the Chairman holding separate discussions with individual Board members. The assessments are discussed at a Board meeting and also serve as a basis for the Nomination Committee’s work to propose Board members.

Remuneration Committee

The Remuneration Committee appointed by the Board of Directors consists of Johan Sjö, Chairman of the Board and Board member Malin Nordesjö, with CEO Niklas Stenberg attending to present information. The Remuneration Committee prepares the “Board’s proposal for principles regarding remuneration of senior executives”. The proposal is considered by the Board of Directors before being submitted for resolution by the Annual General Meeting. Based on the resolution of the Annual General Meeting, the Board of Directors determines the remuneration for the CEO. The CEO does not present information regarding his own remuneration and does not participate in the Board’s decision. Based on a proposal by the CEO, the Remuneration Committee determines the remuneration for the other members of Group Management. The Board of Directors is informed of the Remuneration Committee’s decision. The Remuneration Committee is then tasked with monitoring and assessing the application of the guidelines for the remuneration of senior executives adopted by the Annual General Meeting. The Remuneration Committee shall also monitor and assess programs of variable remuneration for Company management ongoing and completed during the year. During the financial year, the Remuneration Committee met on two occasions.

Audit Committee

The duties of the Audit Committee are performed by the Board of Directors as a whole and are conducted as an integral part of the work of the Board at its regular meetings. The Board member Malin Nordesjö are knowledgeable in the areas of accountancy and auditing. The Audit Committee is tasked with monitoring the Company’s financial reporting, monitoring the effectiveness of the Company’s internal control and risk management regarding the financial reporting, keeping informed regarding the audit of the annual and consolidated accounts, assessing and monitoring the impartiality and independence of the auditor and, in doing so, paying particular attention to whether the auditor provides the Company with services other than auditing services, and helping draw up proposals for the Annual General Meeting when electing an auditor.

In connection with the adoption of the 2020/2021 annual accounts, the Board of Directors was briefed by the Company’s external auditors and presented with their report. At this meeting, the Board of Directors was also briefed by the auditors without the presence of the CEO or other members of Company management.

Auditor

In accordance with the Articles of Association, a registered auditing firm must be elected as auditor. The 2020 Annual General Meeting elected KPMG AB as the Company’s auditor until the close of the 2021 Annual General Meeting. Authorised Public Accountant Joakim Thilstedt is the Principal Auditor and is assisted by Johanna Hagström Jerkeryd.

The company’s auditor follows an audit plan into which viewpoints collected from the Board of Directors have been integrated and reports his observations to the company and business area management teams, to Group Management and the Board of Directors of Addtech AB. This occurs both during the audit and when approving the annual accounts. KPMG audits Addtech AB and nearly all of its subsidiaries. The company’s auditor also takes part in the Annual General Meeting, describing and commenting on his audit work.

The independence of the external auditor is regulated in a specific directive adopted by the Board of Directors. This states the areas where the services of the external auditor, which are not part of the regular auditing, may be enlisted. The company’s auditors continually assess their independence in relation to the Company and each year submit a written affirmation to the Board stating that the auditing firm is independent of Addtech. In the past year, the auditors performed advisory assignments, mainly concerning accounting, taxation matters and listing rules.

Quarterly review by auditors

During the 2020/2021 financial year, Addtech’s six-month or nine-month report was not reviewed by Addtech’s external auditors, representing a deviation from rule 7.6 of the Code. Having consulted the Company’s external auditors on the matter, the Board of Directors does not believe that any benefit and additional expense for the Company for increased quarterly review by the auditors can be justified.

Elected auditor KPMG AB

JOAKIM THILSTEDT

Principal Auditor

Authorised Public Accountant, Stockholm. Born 1967. Joakim Thilstedt has been the Principal Auditor for the Addtech Group since 2016/2017 and is also the Principal Auditor for AFRY, Ahlsell, Concentric and Husqvarna.

JOHANNA HAGSTRÖM JERKERYD

Assistant Auditor

Authorised Public Accountant, Stockholm. Born 1984. Johanna Hagström Jerkeryd has been the Assistant Auditor in the audit of the Addtech Group since 2020/2021 and also works with the auditing of Momentum Group AB, Länsförsäkringar AB, Kinnevik AB, Annehem Fastigheter AB and Svenskt Näringsliv. Johanna is also the Principal Auditor for Kondator AB, Direktronik AB and several other companies, including Servando Bolag AB and ETAB Industriautomation AB.

Chief executive officer and group management

CEO Niklas Stenberg directs the operations in accordance with the Swedish Companies Act and the frameworks established by the Board of Directors. In consultation with the Chairman of the Board, the CEO prepares the data and information needed by the Board of Directors to reach decisions at Board meetings, as well as giving presentations and motivating proposed decisions. The CEO directs the work of Group Management and makes decisions in consultation with other members of Group Management. At the end of the 2020/2021 financial year, Group Management consisted of Niklas Stenberg (CEO), Malin Enarson (CFO), Patrik Klerck (Business Area Manager Automation), Martin Fassl (Business Area Manager Components), Hans Andersén (Business Area Manager Energy), Claus Nielsen (Business Area Manager Industrial Process) and Per Lundblad (Business Area Manager Power Solutions). Group management regularly reviews operations at meetings headed by the CEO.

The Chief Executive Officer is presented in greater detail in the Board of Directors and Management section of this Annual Report and on the Company’s website.

Remuneration of senior executives

The principles for the remuneration of senior executives at Addtech are adopted by the Annual General Meeting. Senior executives comprise the CEO and other members of Group Management. The 2020 Annual General Meeting approved the Board of Directors’ proposal regarding guidelines for the remuneration for senior executives. These guidelines are essentially consistent with the principles previously applied.

Addtech seeks to offer an overall remuneration package that is both reasonable and competitive, while enabling the Company to attract and retain skilled employees. The overall remuneration, which varies in relation to the performance of the individual and the Group, may include the various components stated below. Fixed salary forms the base of the overall remuneration package. This salary shall be competitive and reflect the responsibilities of the position. Fixed salaries are reviewed annually. Variable compensation is based primarily on the Group’s growth in earnings, profitability and cash flow. On an annual basis, the variable component may amount to at most 40 percent of the fixed salary. Each year, the Board of Directors evaluates whether or not a long-term incentive scheme should be proposed to the Annual General Meeting and, if it should, whether the proposed long-term incentive scheme should include the transfer of Company shares or not. Retirement pension, health insurance and other benefits are to be structured in accordance with applicable rules and market norms. Where possible, pensions are to be based on defined-contribution plans.

For further details regarding remuneration for senior executives, please see Note 6 of this Annual Report. The principles for the remuneration of senior executives approved by the Annual General Meeting were adhered to during the financial year.

Long-term incentive schemes

At the end of the financial year, Addtech had four call option programs outstanding, involving a total 3,590,000 Class B shares. The purpose of long-term incentive schemes is to enable Group executives, through an investment of their own, to participate in and work for a favourable trend in the value of the Company’s shares.

The schemes are also expected to generate improved conditions for recruiting and retaining skilled personnel for the Addtech Group, to provide competitive compensation and to unite the interests of the shareholders with those of the executives. The schemes are intended to contribute to executives increasing their shareholding in Addtech over the long term. The executives encompassed by the schemes are those who, in an otherwise heavily decentralised organisation, are able to impact profit positively by means of partnerships between Group subsidiaries. The share-related incentive schemes approved by the Annual General Meeting do not entail a net charge against Company equity.

Remuneration to the Board of Directors and auditors

Each year, the Annual General Meeting of Addtech AB adopts guidelines regarding the remuneration of the Board of Directors and the auditors.

In accordance with the resolution of the 2020 Annual General Meeting, Board fees are to total SEK 2,690,000 and are to be distributed as follows: SEK 740,000 to the Chairman of the Board, SEK 370,000 to each of the other Board members appointed by the Annual General Meeting who is not employed by the Company and SEK 50,000 to each member of the Remuneration Committee. For further details of Board fees, see Note 6 in this Annual Report.

In accordance with the resolution of the Annual General Meeting, auditor’s fees are to be paid in accordance with an approved invoice. For further details of auditor’s fees and of fees for non-auditing services, see Note 7 of this Annual Report.

Operating organisation and management

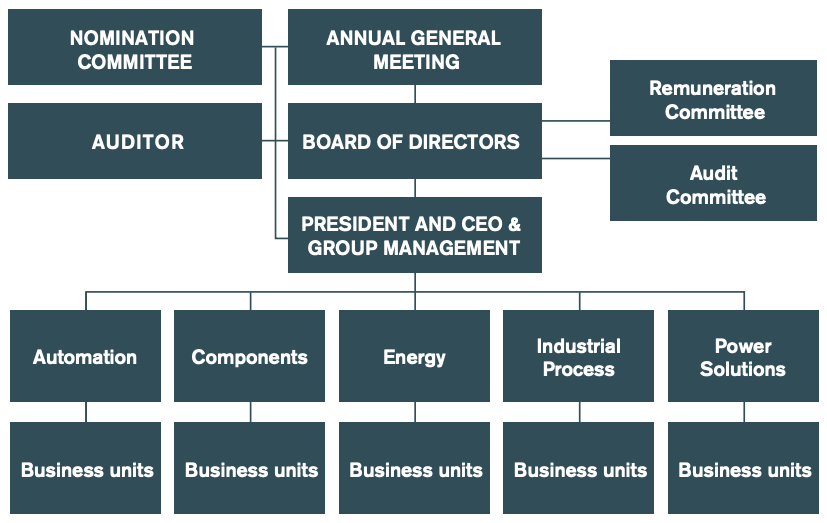

During the 2020/2021 financial year, Addtech was organised into the following five business areas: Automation, Components, Energy, Industrial Process and Power Solutions. The division into business areas reflects Addtech’s internal organisation and reporting system.

Overall, the Addtech Group comprises some 140 independent companies in 20 countries. Although decisions regarding the companies’ operations are taken close to the market, from a governance perspective it is important to integrate the acquired company regarding certain areas of significance for the Group, including financial reporting, administrative procedures and common core values.

Each operating company has a board of directors, in which that company’s Managing Director is a member, as well as executives from the business area or business unit. Within each business area, companies are grouped in business units based on product or market concepts. The Managing Director of each company reports to a Business Unit Manager, who in turn reports to the Business Area Manager. Each Business Area Manager reports to the CEO of Addtech AB. The business areas and business units hold internal board meetings chaired by the CEO and attended by the CFO of Addtech AB, along with the relevant Business Area Manager and controller. Other officials participate in the business area’s Board meetings to present specific matters or if otherwise deemed appropriate.

Systems for internal control and risk management in financial reporting

Internal control

The Board of Directors bears the overall responsibility for ensuring that the Group has an effective system of management and internal control. This responsibility includes evaluating the financial reports that the Board of Directors receives on an annual basis and setting requirements regarding content and format of these reports to assure their quality. This requirement means that the financial reporting must fulfil its purpose while complying with applicable accounting regulations and the other requirements imposed on listed companies. Each year, the CFO reports on the Group’s internal control work to the Board of Directors.

Control environment

Addtech builds and organises its operations around decentralised responsibility for profitability and earnings. In decentralised operations, internal control is based on deeply rooted process that served to define targets and strategies for each area of operations. Internal directives and Board-approved policies convey well-defined decision-making channels, authorities and responsibilities. The Group’s foremost documents for financial control are the financial policy, the reporting manual and the instructions issued ahead of each annual/quarterly closing. A Group-wide reporting system, with related analysis tools, is used in the Group’s process for closing the annual/quarterly accounts. At a more comprehensive level, all operations in the Addtech Group must comply with the Group’s Code of Conduct.

Risk assessment

With regard to the risks that the Board of Directors and Group Management consider significant, Addtech applies well-established procedures of internal control and risk management in its financial reporting. Risk assessments start with the Group’s income statement and balance sheet to identify the risk of material error. In the Addtech Group as a whole, the greatest risks in the financial reporting are associated with intangible non-current assets related to business acquisitions. The exposure is determined by the degree of dependence on internal control or assessments that could affect the financial reporting. The Group applies annual procedures for impairment testing to identify any indications that impairment should be recognised.

Control activities

Control activities include transaction-related controls such as authorisation and investment rules and clear payment procedures, but also analytical controls performed by the Group’s controllers function and the central finance and accounting function. Controllers and finance managers at all levels within the Group play a key role in building environment needed for transparent and accurate financial reporting. The role imposes considerable demands on integrity, expertise and individuals’ capabilities.

Regular finance conferences are held to discuss current issues and ensure the effective sharing of knowledge and experience within the finance and accounting functions. The monthly review of results that is performed via the internal reporting system and that is analysed and commented on internally by the Board of Directors is a key, overarching control activity. The review includes an evaluation of results in comparison with set targets and previous performance, as well as a follow-up of key indicators.

Each year, all Group companies perform a self-assessment regarding matters of internal control. The companies comment on how important issues were handled, such as business terms and conditions in customer contracts, customer credit assessments, checking and evaluating inventory, payment procedures, documentation and analysis of closing accounts, and compliance with internal policies and procedures. For critical issues and processes, an accepted minimum level has been set and all companies are expected to meet this level. The responses of each company are validated and commented on by that company’s external auditor in connection with the regular audit. The responses are then compiled and analysed, after which they are presented to business area management and Group management. The results of self-assessment process are taken into consideration in planning self-assessment and external auditing for future years.

In addition to the self-assessment process, a more in-depth analysis of internal control is performed in about 25 operating companies each year. This process is referred to as an internal audit and is performed at the companies by business area controllers and employees from the Parent Company’s central finance and accounting function. Central processes at the companies, and control points for these, are analysed, tested and recorded. The external auditors study the records kept in connection with the auditing of the companies. The process provides a solid basis on which to chart and assess internal control within the Group. An external party also reviews and assesses the Group’s internal control processes on a regular basis.

Information and communications

Governing guidelines, policies and instructions are accessible from internal digital fora, such as Teams. Codes of Conduct are available publicly on the Addtech website. These documents are updated on an ongoing basis as needs arise. Amendments are communicated separately by e-mail and at meetings for those concerned.

Accessibility of internal information via internal channels is determined by means of authorisations. Group employees are organised into different groups whose access to information differs. All financial guidelines, policies and instructions can be accessed by the Managing Directors, Chief Accountants, Business Unit Managers, Business Area Managers and Business Area Controllers of each of the companies, as well as by the central financial and accounting staff. Financial data at the Group level is also controlled centrally by means of authorisations.

Review

The outcome of the internal control work is analysed and reported annually. An assessment is made regarding what improvement measures should be undertaken in the various companies. The boards of the various Group companies are informed of the outcome of the internal control work within each company and of what improvement measures should be implemented. Together with the boards of the companies, the Business Area Controllers then review these efforts on an ongoing basis over the ensuing years.

The Board of Directors of the Addtech Group receives monthly comments from the CEO regarding the business situation and how the operations are developing. The Board of Directors discusses all quarterly financial accounts and Annual Reports prior to these being published. The Board of Directors is given an annual status report regarding the internal control work and its outcome. The Board of Directors is also informed of the assessment made by the external auditors of the Group’s internal control processes.

Internal audit

Given the risk assessment described above and how the control activities are designed, including self-assessment and in-depth analysis of the internal control, the Board of Directors has chosen not to maintain a specific internal audit function.